Jazz, one of the leading telecommunication companies in Pakistan, offers a range of financial services, including loans, through its mobile wallet platform, JazzCash. If you’re in need of financial assistance, JazzCash can be a convenient option for securing a loan.

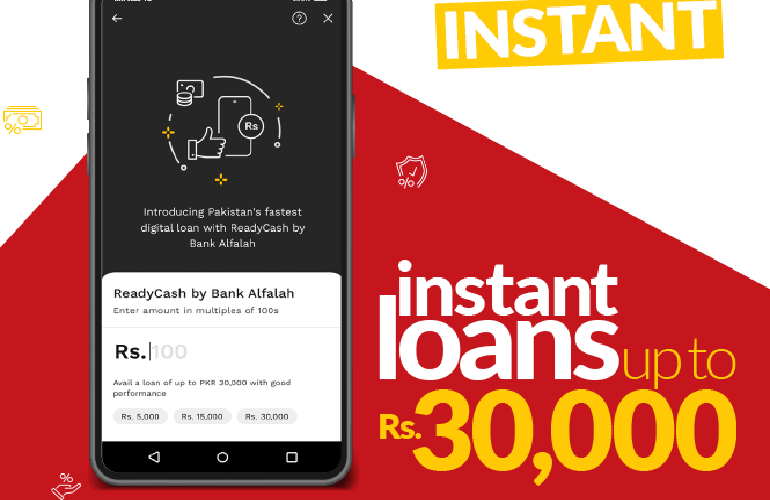

With JazzCash, you can apply for a loan and receive funds directly to your mobile wallet account. In this article, we’ll provide you with a step-by-step guide on how to get a loan in Jazz and walk you through the process of securing up to Rs 30,000 in loan funds. Whether you’re looking to cover unexpected expenses or fund a business venture, JazzCash loans can be a useful tool in achieving your financial goals.

How to Apply for Jazz Loan?

ReadyCash is a loan product offered by JazzCash that provides quick and convenient access to funds. If you’re interested in applying for a ReadyCash loan, here are the steps you need to follow:

- Ensure that you are eligible: To be eligible for a ReadyCash loan, you must have a JazzCash mobile wallet account and a valid CNIC (Computerized National Identity Card).

- Dial *786#: Once you’ve confirmed your eligibility, dial *786# from your registered JazzCash mobile number.

- Select “ReadyCash Loan”: From the menu, select “ReadyCash Loan” and follow the prompts to input your desired loan amount.

- Provide necessary information: You will be prompted to provide additional information, such as your CNIC number and income details.

- Accept the terms and conditions: After providing the necessary information, you’ll need to review and accept the terms and conditions of the loan.

- Wait for approval: Once you’ve completed the application process, you will receive a notification regarding the status of your loan application.

- Receive funds: If your application is approved, the loan amount will be disbursed directly to your JazzCash mobile wallet account.

What are the Charges for the ReadyCash loan?

The charges for the ReadyCash loan may vary based on the loan amount and repayment period. JazzCash charges a flat 5% processing fee on the loan amount, which is deducted from the disbursed loan amount.

In addition to the processing fee, the loan amount is subject to a service charge of 0.75% per day for the first 14 days and 1.5% per day thereafter. This means that if you take out a ReadyCash loan of Rs 10,000 and repay it in 14 days, you will be charged a service fee of Rs 75 per day. If you don’t repay the loan within 14 days, the service fee will increase to Rs 150 per day.

It’s important to note that these charges are subject to change, and you should always review the terms and conditions of the loan before applying. Additionally, failure to repay the loan on time may result in additional charges and impact your credit score. Therefore, it’s essential to ensure that you can repay the loan within the agreed-upon timeframe before applying for a ReadyCash loan.

How to repay the ReadyCash loan?

Repaying a ReadyCash loan from JazzCash is a simple and straightforward process. Here’s how you can repay your loan:

- Ensure sufficient funds: Make sure that you have sufficient funds in your JazzCash mobile wallet account to cover the loan amount and any applicable fees and charges.

- Dial *786#: Dial *786# from your registered JazzCash mobile number and select the “ReadyCash Loan” option.

- Select “Repay Loan”: From the menu, select the “Repay Loan” option and follow the prompts to input the loan amount you wish to repay.

- Confirm repayment: Review the loan repayment details, including the loan amount and any applicable fees and charges, and confirm the repayment.

- Wait for confirmation: After confirming the loan repayment, you will receive a confirmation message regarding the successful repayment of your loan.

How to view your payment history?

If you have taken a ReadyCash loan from JazzCash, you may want to view your payment history to keep track of your loan repayments. Here’s how you can view your payment history:

- Dial *786#: Dial *786# from your registered JazzCash mobile number.

- Select “My Account”: From the menu, select the “My Account” option.

- Select “Mini Statement”: From the “My Account” menu, select the “Mini Statement” option.

- Enter the required information: Enter the start and end date of the period for which you want to view the payment history.

- View the payment history: After entering the required information, you will receive a message with details of all transactions during the specified period, including loan repayments and any applicable fees and charges.

For how long can I take the loan?

The repayment period for a ReadyCash loan from JazzCash is typically 30 days, although you may have the option to choose a shorter repayment period. You will be required to repay the loan amount along with the applicable fees and charges within the agreed-upon timeframe.

If you are unable to repay the loan within the repayment period, you may have the option to extend the loan for an additional period by paying a rollover fee. However, it’s important to note that rollovers may result in additional fees and charges, and can increase the overall cost of the loan.

It’s essential to carefully review the terms and conditions of the loan before applying, and to ensure that you can repay the loan within the agreed-upon timeframe. Failure to do so may result in additional fees and charges, and can negatively impact your credit score.

FAQS

How much ReadyCash Loan can I get?

The amount of ReadyCash loan you can get from JazzCash depends on your creditworthiness and the lender’s policies. However, typically, the loan amount ranges from Rs. 1,000 to Rs. 30,000.

How many times I can take the loan?

You can take a ReadyCash loan from JazzCash as many times as you want, provided that you have paid off your previous loan and meet the eligibility criteria for a new loan. However, taking multiple loans simultaneously may impact your credit score and ability to repay, so it’s important to borrow responsibly and only when necessary.