As we know that the Zong collects taxes on calls, SMS, and internet bundles and these taxes pay by customers. So you must need a Zong Tax certificate with all of your annual tax statement records. This withholding income tax certificate you can attach with the income return file and submit to FBR to show your real spending in a whole year.

Hence, here we will give you guidelines on how Zong prepaid and postpaid customers can get their tax deduction certificates for their SIMs. You can get this document from the official Zong E-Care application. With the help of this certificate, you can easily find out the total deduction withheld tax for a whole year.

Ideally, all network in Pakistan already has an e-care portal, apps, SMS, and WhatsApp services to download Tax statement for free. You can use anyone for your convenience.

Zong 4G offers more than three ways to download the tax document. We are going to explain each one in detail. Before getting into the details, Let’s take a look at what is Zong Tax certificate is.

What is Zong Tax Certificate?

It is a proof document that included all the amount that you paid in terms of tax (For GSM/MBB/Internet SIMs) during one year. This certificate trigger whenever a customer request or demands regardless of subscription type – Postpaid or Prepaid.

Every Zong customer paying sales tax and as well as Advance tax. So at the end of the Financial year (1st July “20XX to 30th June” 20XX ) Zong makes available the tax certificate of advance tax for customers. Now customers can request it or download it from different sources provided by the company.

In simple words, it is payment proof of due taxes while doing recharge your phone balance. This is the amount of tax that you pay when you active package or recharge your account. Anyway, let’s go through and see how you can the certificate.

How to Get Zong Tax Certificate?

Getting Tax certificate with yearly tax paid proof is now easily available online. Both prepaid and postpaid users don’t need to visit the Zong franchise or customer care center. They can get the tax PDF certificate while staying at home free of cost.

Let’s take a look what are the ways to get the important document:

- Certificate from Zong E-Care

- Through My Zong App

- Via Official Zong Email

Zong Tax Certificate Via E-Care

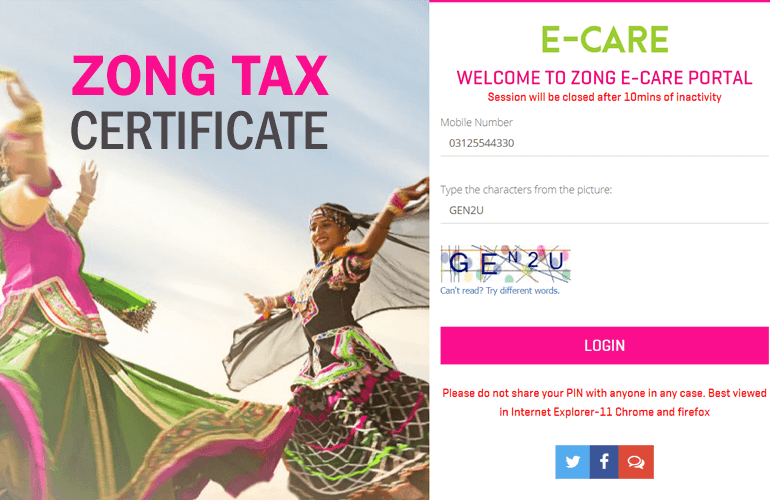

1st method to check and download Zong Tax Certificate is from Zong E-Care’s official website. This is an online portal design for listing important documents. The service is reliable for both postpaid and prepaid customers.

Here are steps you have to follow

- Go there https://ecare.zong.com.pk/

- Now put your Zong SIM mobile number

- In 2nd box enter verfication characters.

- After that, Click on “Login” button to get access to your account.

- You will get the verification code on your number that you need to enter on the next page.

- Now you are in the portal area and from here you click on “Usage History“

- From here Select the Date Month/Date/Year to get the Zong Tax Certificate.

- You can download and print it then use it whenever you neeed.

This is the simple and easy-to-understand procedure to download the certificate through the e-care website.

Also Check:

Get Certificate from My Zong App

By using the “My Zong App” you can get the Zong Incom Tax Certificate without any cost. The certificate will be in PDF form and you can print it.

Follow these five steps and get your Zong certificate right away.

- Go to Google Play store and install “My Zong App“

- Next go to home page and scroll down to see the Tax Certificate Icon.

- Click on “Tax Certificate” which will located in thrid line.

- You will redirect to another web page with basic options.

- Simply type “Start Date” & “End Date” for certificate duration.

- Now click on the “Download Tax Certificate” button and wait for few seconds.

- Your tax statement/certificate start downloading.

Withholding Incom Tax Via Zong Email

If the above methods do not work for you then you need to get in touch with Zong through Email support. Although this method isn’t reliable you can give it a try only when you can’t download the certificate from the care portal or app.

The preferable method is using Zong E-Care or Zong my App to download the certificate. However, you can also send an email to Zong’s official email address and request the authorities for a Tax statement.

Conclusion

Hope this post will help you to get the required document. If having an issue you can also post a comment below and I will try to help you. All the methods work 100% correctly so make sure you follow the steps with care.

It’s not working either way. Thought the app oe E-portal. Even thought CCC. Only making you get sick.

Bilal working fine. What’s a problem with you. Can you please share the error message you are getting while downloading the certificate?